We’re seeing immense seller and investor activity in the marketplace and want to share our top 5 reasons why owners are selling their businesses in 2021.

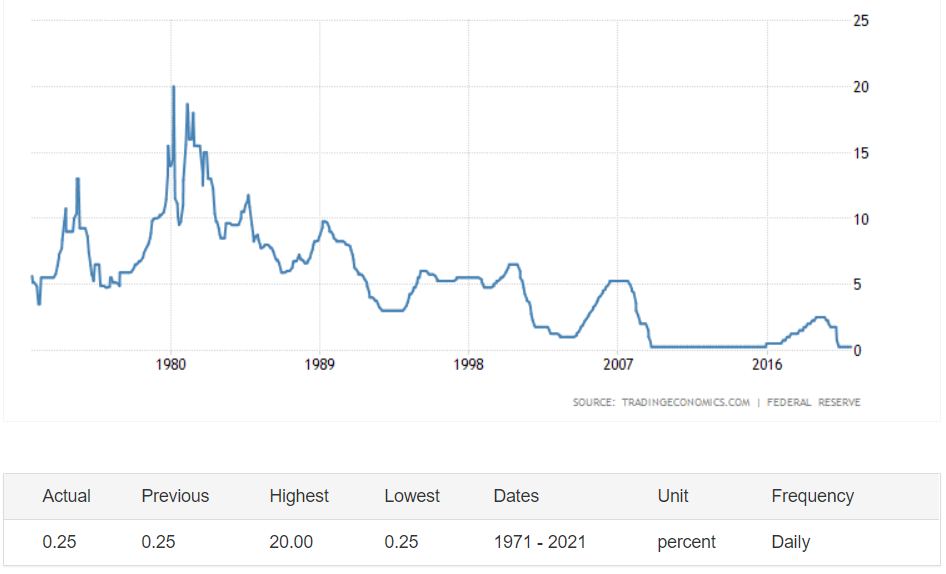

5. Low Interest Rates and Access to Capital

As of the writing of this article, the US federal funds rate is at a 50-year low of 0.25%, which means it’s very inexpensive for investors to borrow money. They can now afford to buy more businesses or larger businesses than they could in previous years. Many transactions involve some form of debt leverage that enables investors to avoid burning up all their available cash. They then have remaining funds they can use to quickly jump on opportunities.

Figure 1 US Fed Funds Rate https://tradingeconomics.com/united-states/interest-rate

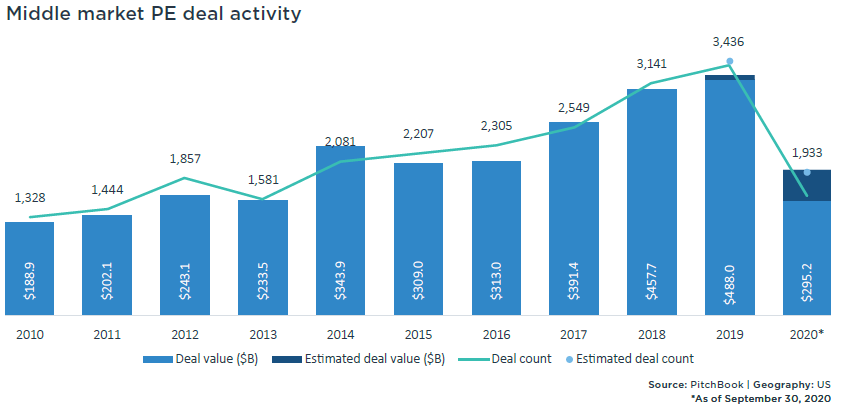

4. The Market is Red Hot!

Investors have FoMo (Fear Of Missing Out) because in 2020 a drastically lower number of deals was available to them. Many business owners who were considering selling their company in 2020 held off. They wanted to wait until their operations regained their pre-COVID momentum and more certainty developed in the marketplace.

Many Private Equity (PE) groups have raised large amounts of committed funds from investors, and they can’t just sit on that cash. PE firms have to deploy that capital to execute new platform acquisitions or add-ons or invest in current portfolio companies to provide a return for their investors. Since there was a limited number of investment opportunities last year (as shown in the chart below), many investors didn’t meet their expected number of acquisitions. In 2021, they are playing catch-up.

Figure 2 PitchBook US PE Middle Market Q3 2020 Report

3. High Business Valuations

There is currently a low supply of quality businesses for sale and exceptionally high investor demand. This atmosphere creates higher business valuations. The Mergers & Acquisitions (M&A) process like the one used at Affinity Ventures (AV) creates multiple competitive offers for the company. Since we never set an asking price for a business, the value is determined by the marketplace and typically goes to the highest and most competitive offer. As you know, when demand exceeds supply in the market, it drives up prices of existing businesses and creates a favorable environment and added value for sellers until the new market equilibrium is reached. As an example, we’re currently selling a client’s business using this confidential controlled auction process and have over 145 interested parties. We expect a minimum of 10 offers for our client’s business.

2. Biden’s Capital Gains Tax Increase and Baby Boomers

In case you missed our previous analysis of the Biden Administration’s plan to essentially increase capital gains tax on the sale of a business from 20% to 40%, you can read the full article on LinkedIn, our AV website, or YouTube. Many smart business owners are preparing to sell their businesses before this tax hike. These business owners know that if they sell now, while taxes are low, they can get substantially more after-tax proceeds than if they wait to sell when taxes double from 20% to 40%. Sellers will roughly need to increase their revenue and earnings by an estimated 33% to get the same amount of after-tax proceeds if they wait to sell under this new projected 2022 tax increase.

Baby Boomers make up the largest generation of business owners in America, and most will be looking to exit in the next few years in preparation for retirement. This capital-gains tax increase could accelerate that process.

1. External Technology, Labor, and Political Changes Forcing Businesses to Change or Die

The year 2020 completely changed the landscape of how the world does business, and it’s not going back. We’ve seen sudden changes in the marketplace due to the coronavirus pandemic, and the government’s response has caused businesses to close, shut down, or drastically change the way they operate to stay open. Artificial intelligence, machine learning, and other new technologies are being deployed in every business sector to make companies more competitive and help them operate with less human labor. There have also been multiple calls for the government to increase the minimum wage to $15 per hour.

Such external market forces can be overwhelming for many business owners to prepare for, monitor, and adapt to because many of them are focused on the already large task of operating their business. It also takes capital to keep up with constant change. By the time owners fully understand the environmental, social, and governance changes going on around them, it may be too late. The best time to sell your business is when it is doing well, as opposed to when sales are flat or declining. Very few investors will want to catch a falling knife. We offer owners Complimentary Market Valuations to help them determine where they’re at in the business lifecycle and best plan their exit. It takes on average 6 to 9 months to properly sell a business and maximize its value. If this is something you’re interested in, we encourage you to contact us today and schedule your free consultation