The Proposed Biden Tax Plan Will Double Taxes When Selling Your Business

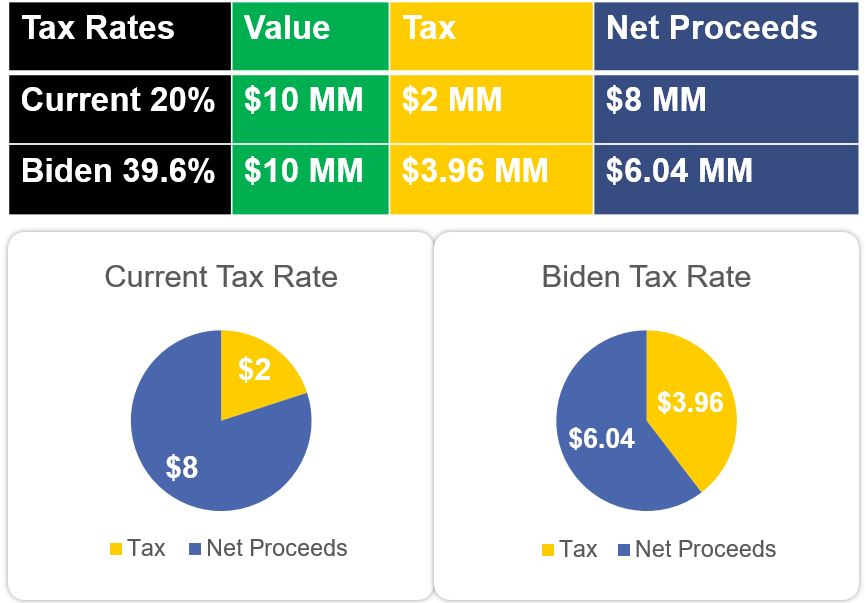

If you are thinking about selling your business in the next 4 years this proposed increase in capital gains tax could have a massive impact on the net proceeds from the sale of your business. Currently, when business owners sell their company for more than $1MM they pay capital gains tax of 20%. The new Biden administration has proposed to have all business sale transactions over $1 Million taxed at the ordinary income tax rate at 39.6%!

This will essentially double the capital gains tax rate from 20% to 40%.

As an example of this, let’s take a $10MM company. Currently at 20% capital gains the owner would pay $2MM in taxes. Under the proposed Biden plan the owner would pay tax at 39.6% or $3,960,000 in taxes. That is an additional $1,960,000 a business owner would pay if they wait to sell under this new tax code. Many owners who are aware of this proposed tax increase are preparing for a significant liquidity event in 2021 by having us sell all or part of their company using our competitive offer process.

Most tax experts are projecting this tax hike to become effective in late 2021 or the early part of 2022. If you want to exit on your terms and pay less taxes, the time to move forward may be now.

To properly sell a business and maximize the value it takes on average 6 to 9 months, so if this is something you are interested in we encourage you to contact us to get started today. We will schedule your free consultation and complimentary market valuation. Click the link below to get started.

https://go.affinityventures.com/merger-acquisition